The National Assembly has ordered the re-gazetting of four major tax reform laws amid public controversy over alleged post-passage alterations, insisting the move is purely administrative and aimed at protecting the integrity of the legislative record.

In a statement issued on Friday, December 26, by the House of Representatives spokesperson, Akin Rotimi, the leadership of both chambers of the parliament directed the Clerk to the National Assembly to re-gazette the Acts and issue Certified True Copies (CTCs) of the versions “duly passed by both chambers of the National Assembly.”

The directive follows growing public commentary surrounding the passage, presidential assent and publication in the Federal Government’s Official Gazette of the Nigeria Tax Act, 2025; Nigeria Tax Administration Act, 2025; Joint Revenue Board of Nigeria (Establishment) Act, 2025; and the Nigeria Revenue Service (Establishment) Act, 2025.

It could be recalled that On 26 June 2025, President Bola Ahmed Tinubu signed into law a historic package of tax reform legislation, marking the most comprehensive overhaul of Nigeria’s fiscal architecture in decades.

The four new tax laws are:

The Nigeria Tax Act (NTA): This Act consolidates and harmonizes numerous existing tax statutes, such as the Companies Income Tax Act, Personal Income Tax Act, and Value Added Tax Act, into a single, unified law to simplify the tax system and reduce compliance burdens.

The Nigeria Tax Administration Act (NTAA): This legislation establishes a consistent legal and operational framework for the fair and efficient administration of all tax laws across federal, state, and local governments, promoting clarity and digital compliance.

The Nigeria Revenue Service (Establishment) Act (NRSA): This law repeals the previous Federal Inland Revenue Service (FIRS) Act and establishes the new Nigeria Revenue Service (NRS) as an autonomous and performance-driven central agency responsible for the assessment and collection of all federal tax and non-tax revenues.

The Joint Revenue Board (Establishment) Act (JRBA): This Act creates a formal governance structure, the Joint Revenue Board (JRB), to enhance cooperation and coordination among all tiers of government’s revenue authorities. It also establishes the Tax Appeal Tribunal and the Office of the Tax Ombudsman for dispute resolution and taxpayer protection. These consolidated tax laws that will form the basis of a new tax regime reforms, aim to streamline revenue administration, improve the business environment, and expand the tax net while providing relief for low-income earners and small businesses, The Nigerian government has enacted four new, effective January 1, 2026.

But, according to the House, the concerns raised touch on “the harmonisation of Bills passed by the Senate and the House of Representatives, the documentation transmitted for Presidential assent, and the versions of the Acts subsequently published in the Official Gazette.”

The House Spokesman, Rotimi, said the legislature was already handling the matter strictly within its constitutional powers.

“The House of Representatives wishes to assure the public that these matters are being addressed strictly within the constitutional and statutory remit of the National Assembly,” he said.

Rotimi disclosed that only last week, the House constituted a seven-man Ad Hoc Committee after the issue was raised on the floor through a Point of Order (Privileges).

“The Ad Hoc Committee, alongside other relevant Committees of the National Assembly, working in collaboration with the management of the National Assembly, is undertaking an institutional review to establish the sequence of events and to identify any factors that may have contributed to the circumstances surrounding the legislative and administrative handling of the Acts,” the statement said.

He explained that the review would include “a careful examination of any lapses, irregularities, or external interferences, should any be established,” stressing that the exercise is being conducted “in full conformity with the Constitution of the Federal Republic of Nigeria, the Acts Authentication Act, the Standing Orders of both Chambers, and established parliamentary practice.”

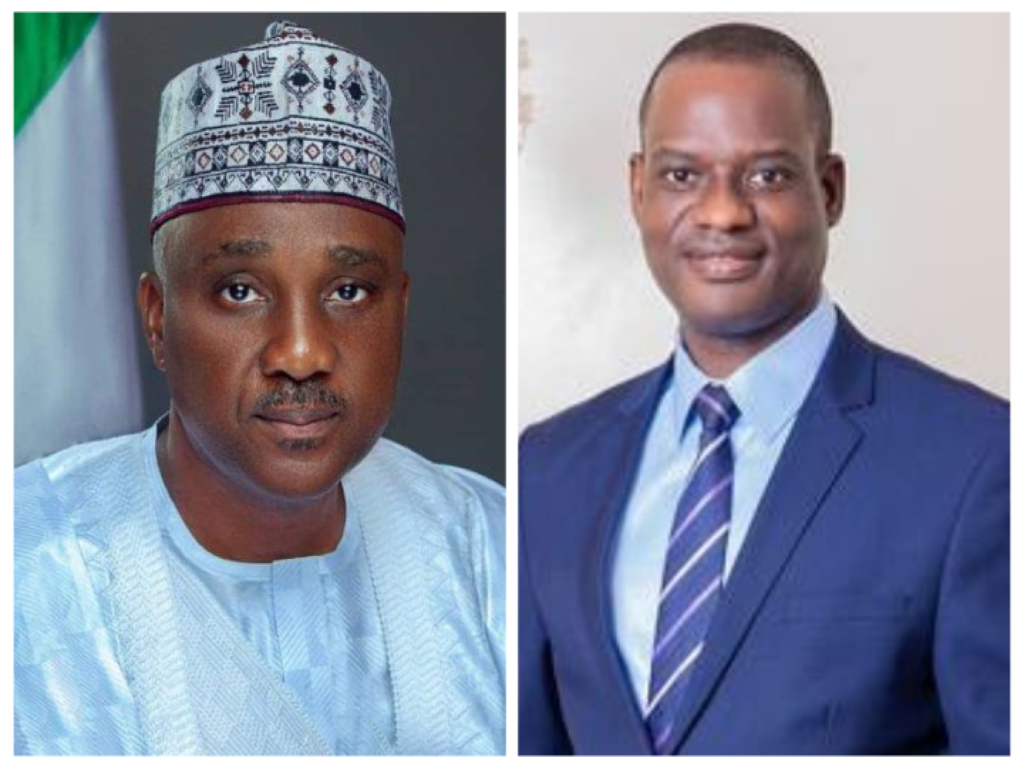

He said as part of the process, the leadership of the National Assembly, under Senate President Godswill Akpabio and Speaker of the House Abbas Tajudeen, directed the re-gazetting to clear any ambiguity.

“This administrative step is intended solely to authenticate and accurately reflect the legislative decisions of the National Assembly,” the House said.

The statement noted that the review did not amount to an admission of wrongdoing.

“This review is strictly confined to institutional processes and procedures. It does not constitute, imply, or concede any defect in the exercise of legislative authority by the House of Representatives or the Senate,” the statement read.

It further clarified that the action was taken “without prejudice to the powers, functions, or actions of any other arm or agency of government” and would not affect “any rights, obligations, or legal processes arising under the Constitution or any other applicable law.”

Reaffirming its commitment to democratic norms, the House said it remains “firmly committed to the principles of constitutionalism, separation of powers, due process, and the supremacy of the rule of law.”

“Where procedural or administrative refinements are identified, appropriate corrective measures will be taken in accordance with the law and established parliamentary conventions,” Rotimi added.

The House also appealed to the public to exercise restraint

“Members of the public are respectfully urged to allow the National Assembly’s institutional processes to proceed without speculation or conjecture,” the statement said, assuring that the leadership of the House remains committed to “transparency, accountability, and the faithful discharge of its constitutional responsibility as custodian of the legislative authority of the Federal Republic of Nigeria.”

The House said further details would be provided as the review progresses.